Reuters survey: Bank of Japan likely to hike rates to 0.75% in Q3

Robert Besser

25 Feb 2025, 10:54 GMT+10

- The Bank of Japan is expected to raise interest rates once more this year, likely in the third quarter, bringing the rate to 0.75 percent, according to a Reuters poll released this week

- While central banks in other major economies are considering rate cuts, the BOJ remains focused on gradually increasing borrowing costs

- The Japanese swap market reflects expectations of further hikes, pricing in a 69 percent chance of two additional 25-basis-point increases by the end of 2025

TOKYO, Japan: The Bank of Japan is expected to raise interest rates at least once more this year, likely in the third quarter, bringing the rate to 0.75 percent, according to a Reuters poll released this week.

While central banks in other major economies are considering rate cuts, the BOJ remains focused on gradually increasing borrowing costs. Over 65 percent of economists surveyed, 38 out of 58, predicted the next rate hike would come in July or September.

"It will be necessary to confirm the rate of pay rises in this year's wage talks and examine the impact of January's interest rate hike," said Junki Iwahashi, senior economist at Sumitomo Mitsui Trust Bank.

The Japanese swap market reflects expectations of further hikes, pricing in a 69 percent chance of two additional 25-basis-point increases by the end of 2025.

BOJ board members have signaled the need for continued rate hikes, warning that keeping rates too low could lead to excessive risk-taking and inflationary pressure.

July is seen as a likely timing for the next hike, as it would follow a six-month gap from January's decision and come after the Upper House election, noted Masato Koike, senior economist at Sompo Institute Plus.

The BOJ raised interest rates to 0.50 percent in January—the highest level since the 2008 financial crisis—citing progress toward its two percent inflation target.

Rising wages have also strengthened the case for rate hikes. The poll showed that analysts expect a five percent increase in pay during this year's spring labor-management negotiations, up from 4.75 percent in last month's survey.

"It is expected that high-level wage increases will be made to retain workers due to a shortage of manpower and prolonged inflation," said Kyohei Morita, chief economist at Nomura Securities.

However, Morita cautioned that some smaller firms may struggle to sustain wage hikes if profitability does not improve.

Economists forecast the BOJ's interest rate will reach one percent by March 2026. The long-term outlook remains uncertain, with predictions for the terminal rate ranging from 0.75 percent to two percent.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Shanghai Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Shanghai Sun.

More InformationInternational

SectionMississippi judge tells newspaper to drop editorial criticizing mayor

CLARKSDALE, Mississippi: A judge in Mississippi has ordered a newspaper to take down an editorial that criticized the mayor and city...

Israel accused of criminalizing defense of human rights

JERUSALEM, Israel - Two bills that have passed a preliminary reading in the Knesset have raised concerns among civil society groups...

Italy probes BYD, Stellantis, Tesla, and VW over EV performance claims

MILAN, Italy: Italy's competition authority has launched an investigation into four major automakers—BYD, Stellantis, Tesla, and Volkswagen—over...

US military ordered to identify $50 billion in cuts for 2026 budget

WASHINGTON, D.C.: The Pentagon said this week that it has asked the military to find ways to cut about $50 billion from the 2026 budget....

Hawaii State Capitol renovation could cost $100 million

HONOLULU, Hawaii: The Hawaii State Capitol needs significant repairs, which will cost between US$50 million and $100 million and could...

US Border Patrol arrested 29,000 migrants on Mexican border in January

WASHINGTON, D.C.: The U.S. Border Patrol arrested 29,000 migrants crossing the U.S.-Mexico border illegally in January, the agency...

Asia Business

SectionReuters survey: Bank of Japan likely to hike rates to 0.75% in Q3

TOKYO, Japan: The Bank of Japan is expected to raise interest rates at least once more this year, likely in the third quarter, bringing...

Google plans first retail stores outside US, eyes India launch

NEW DELHI, India: Google is preparing to open its first physical retail stores outside the U.S., with locations in India likely to...

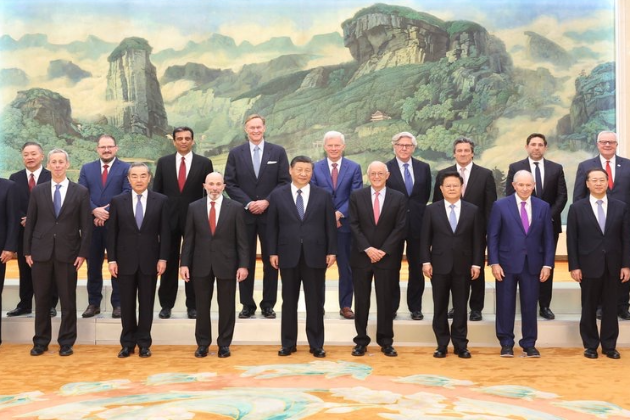

China’s Xi Jinping reassures private sector on policy stability

BANGKOK, Thailand: China's President Xi Jinping met with private sector leaders this week and assured them that the government's policies...

Nifty, Sensex open flat, Expert say little to cheer with bleak global scenario

Mumbai (Maharashtra) [India], February 25 (ANI): Indian equity markets remained under pressure as both the Nifty 50 and the BSE Sensex...

Court issues notice to BJP MLA in defamation complaint filed by BJP MP

New Delhi [India], February 24 (ANI): The Rouse Avenue court on Monday issued a notice to a BJP MLA in a defamation complaint filed...

Nifty, Sensex drop over 0.7 pc at open, muted Q3 earnings and FIIs selling contributing in decline

Mumbai (Maharashtra) [India], February 24 (ANI): Indian stock markets started the week on a weak note, continuing their downward trend...